How to maximize benefits from investing in IPOs?

Well, I'll burst one bubble in the first line itself. Unless you're a God or involved in fraud, there is absolutely no guarantee when it comes to IPO allocation.

But then, why should you, me or any other retail investor even bother with IPOs. We see so many people cribbing about not being able to get allocation at all or have gotten a bad draw when their IPO allotment loses money on listing day.

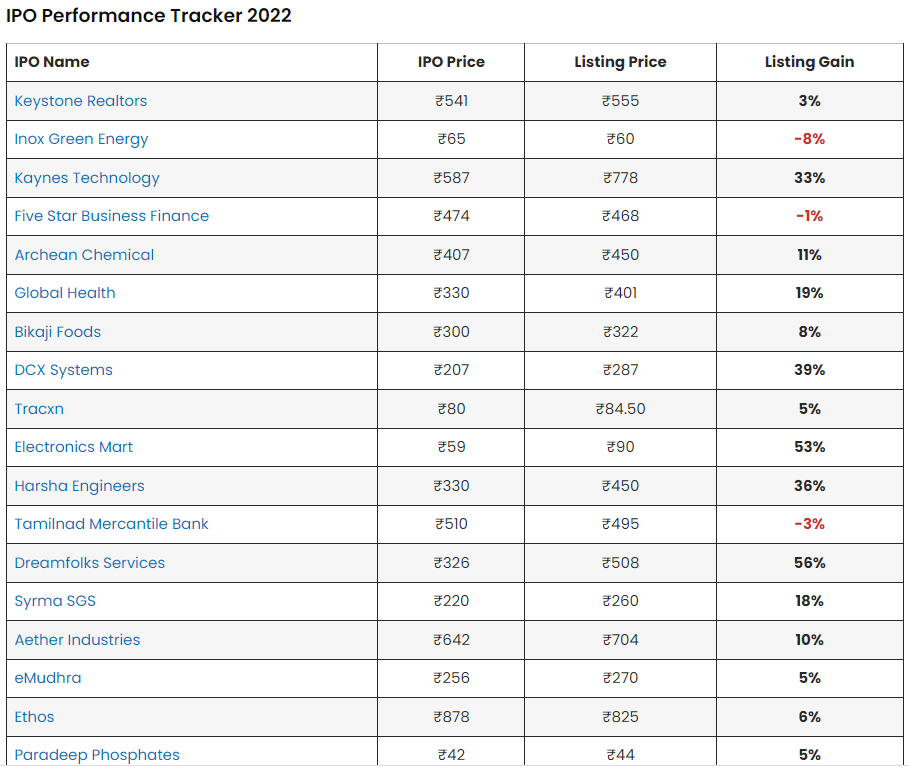

The answer lies in realising that IPOs are indeed a good way to earn some "quick" gains with minimal risk*. Take a look at this snapshot of listing gains of some IPOs in 2022 from ipowatch.in (https://ipowatch.in/ipo-performance-tracker/)

One can see that the chance of a listing gain is decent (you may look at the overall list to get a better picture).

Keeping aside the luck factor in actually getting an allotment, there are a few pointers one can keep in mind to benefit from the many IPOs that happen in any given year.

- Information Asymmetry - Know that as a retail investor, you have the least information about anything and everything concerning an IPO. Basically you have access to information that is mandated by law to be published before the IPO. Large Instituional Investors - QIBs, FIIs and even certain HNIs have access to a lot more information from the "Market" simply by being the people with the money. They arent cheating per say (as in I am not implying insider trading) but by being themselves, people are constantly giving them information on a platter in the hope that they will invest in the IPO or use their services (broking, advsiory etc.). So how can a retail investor use this to their advantage? Simple, DO NOT APPLY TILL THE LAST DAY AND IF POSSIBLE NOT TILL THE LAST HOUR (Possible from my experience through UPI application). The QIBs, FIIs etc usually apply on the last day and if there is no oversubscription here, then I believe the IPO will most likely have a very forgettable listing. Think about it, if the large investors who have all the access to information along with teams that spend days analysing companies are not hungry for the IPO, why should you or I get caught holding on to a dud investment?

- GMP - This is the fabled Grey Market Premium that every Tom Dick and Harry quotes but most dont know how and where it comes from. While that is for another discussion, it still is a very important factor to decide whether to apply for an IPO or not. Simply speaking, its the premium (listing gains) expected over the listing price on the day of listing. So if GMP reported is ~20% then its reasonable to expect a similar listing gain. Now keep in mind that GMP changes daily and if the overall market sentiment is volatile, then the change in GMP could be drastic. This in addition to the relatively long waiting period between allotment and listing could end being a negative listing day if GMP is low enough. Remember, once alloted in an IPO means that there is no going back and exit is only at the day of listing. So if youre not comfortable with the GMP, its better to avoid applying. Usually there seems to be a strong correlation between GMP and QIB participation. But in my opinion, its better to wait till the end before making our move

- (There is a welcome change here (dated Dec 2023 but keeping this comment to document the earlier process) Know that your money is stuck for at least a week if not more in the process of IPO allotment. One of my pet peeves , I strongly believe that we need to have a much shorter waiting period between application, allotment and listing instead of the 3-5 days minimum between each step that we currently see. So in case you're thinking of cycling a particular amount of money for this purpose, you will not eb able to do so in case 2-3 good IPOs show up one after the other.

- Number of lots to apply - For a hot IPO, its almost no use if you apply 1-2 lots (INR 14,000 - INR 28,000) since allocation by lottery reduces your chance of getting alloted. So if youre confident about an IPO, go for larger lots (within your means people...please dont borrow funds for this). So assume you bid for 4-5 lots, theres a higher chance youll get at least 1 or if youre lucky, you'll get more.

- Keep trying - There are many IPOs in a given year (mainline IPOs that list on NSE, BSE with minimal lot size of ~INR 14000 and not SMEs which we will cover in a later post) and if you dont get even in 4-5 IPOs, youll defintely find many more worth applying for.

The above steps have helped me identify at least 3 good IPOs (Dec - Jan 2023)till now and have also helped me avoid a few less savoury ones. Im reasonably confident about this method since I have tested them with my own money. Three recent IPOs where I have used these steps are as follows:

a. Archean Chemicals - Applied for 2 lots and got 1. Some 20% gains and I exited on the listing day

b. Keystone Realtors - This was almost a mistake but Im glad I experienced this one. This was an exeption to point 1 mentioned above. QIBs oversubscribed to the issue but there was no support from retail (0.53 times subscribed). I think this was becuase the GMP data for this issue was not available for quite some time. I got a full allotment as a result (2 lots out of 2) and got out with a 3% gain. This could have easily gone bad since I later realised that GMP was quite low (as can be seen from listing).

c. Dharmaj Crop Guard - At the time of writing, there is one more day left for allotment. But this has been a competitive IPO with strong oversubscription from all categories of investors. But again, we see a nearly 5 day (3 working day) wait for allotment and another 2 days for listing. A lot could happen in this time, though from the GMP data, it looks to be a good launch. Writing this on Dec 6 (7 pm) I can disclose that I havent got an allocation. The listing will be in a day or so and will update this again at that point.

d. Dated Nov 30, 2023: Tata Technologies IPO: This was probably the most anticipated main board IPO of 2023. And boy... it did not disappoint. Listed at 140% gains and closed the first day of listing at 160% (Base price of INR 500 per share). Here the GMP, subscription status across all categories and every other indicator of a successful IPO were crustal clear and all that was required was some heavenly and karmic blessings. I personally got 1 lot allotted (applied for 1 lot only) and exited at 160% gains (a cool INR 24000 /- profit).

I hope you found this article educational and hope you find some benefit from this. Again, please note that these pointers are useful only if you're looking to benefit from listing gains and long term performance assessment is required if you want to hold the investment. These are purely my observations and again are not a guarantee on returns or financial advice

*minimal risk - Considering that GMP seems to be reasonably strong indicator of listing gains, as long as your not leveraged, IPO investing seems to have a rather low risk profile.

Edit: Dated Novemebr 30, 2023: In Aug 2023, in what can be termed as a great intervention on behalf of investors, the SEBI brough out a circular halving the IPO Listing time from T+6 to T+3 days. T here being the close of the IPO. This would be effective compulsarily for all IPOs from Dec 1, 2023 and will lead to improved IPO particpation from the public allowing retail participants from getting their money back much quicker. Furthermore, this would definetly have an impact on the listing price since the chance of the GMP being affected by market volatilities would reduce.