The curious case of Adani Power

The last 3 years have been a wild ride for the Adani Group Stocks as a whole.

Case in point?

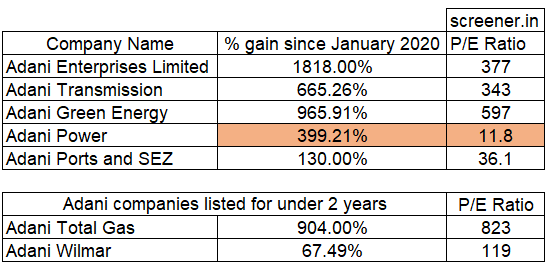

Have a look at the % returns in this period (also have a look at the PE ratios).

What can be almost immediately noticed is that Adani Power, despite the meteoric rise in share price is a lot cheaper (based on PE ratio) than every other Adani company by a mile.

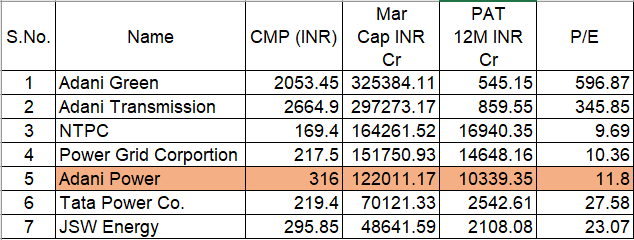

Now let’s see how Adani Power fares among its own peers in the Power Generation and Distribution Sector. For this case, I have taken the 7 largest companies in this sector by market cap. This includes giants like NTPC, PGC, Tata Power etc.

The companies in positions 3,4,5 are interesting to our assessment. They are quite cheap compared the top 2 companies and each had at least INR 10000+ Cr of PAT in the preceding 12 months (TTM), while maintaining a market cap of at least INR 1+ Lakh Cr. The last 2 companies in the pic while still cheaper than the first 2 have PEs at least 2 times the middle 3.

Let’s now bring back our focus to Adani Power. Here is an Adani Company that has zoomed ~400% in share price in 3 years but at the same time has a PE under 15. Furthermore, it is not a PSU like the other 2 companies in the sector with similar PEs, thereby not being hindered by politically driven pricing for its energy production. Another interesting fact is that it has ~75% of its shares held by the Promoters which I believe is a stong point of the Adani way of doing business (I noticed this first when Adani Transmissions was at INR 180 per share).

While Adani Power has had several years ending in business losses, it appears that with its current set of 8 Power plants being operational and 5 more upcoming ones, the profitability of the company has a high chance of stabilizing in the next few years. Its Debt to Equity Ratio of 2.2 as on March 31, 2022 is also somewhat reassuring considering the leverage situation of some of the other Adani Group Companies

The Adani group has launched a major offensive to be the top name when it comes to infrastructure in India. So much so that there are genuine concerns that should they fail, it could be a major dent to the India Story. But I believe that the man helming the group can lead it to the finish line in one piece.

But all that aside, I sense an opportunity with this Adani group laggard. Here we have a profitable yet cheaply priced entity that is part of one of India's hottest family of stocks that still looks like it has space to go upward. I believe that this is a case of a mispriced stock and the market will soon notice this, if not already. Therefore, one might consider investing here should they want a piece of the Adani story without compromising too much on valuation metrics.

Finally, I inform the reader that I have put in some of my own money into Adani Power and that none of the above constitutes Financial advice. Please do your own research while investing in Equities. I welcome the readers’ feedback on this and other articles. You may reach out to me on bhat.pradhyumna@gmail.com

Note: All data has been obtained from Screener.in, Google Price Charts and the FY22 Adani Power Annual report.