What is ASM Framework? Why have Adani Stocks been placed under the ASM Framework List?

The ASM (Additional Surveillance Measure) Framework is an initiative by the Securities and Exchange Board of India to enhance security and overall experience of Retail Investors in the Indian Equities Market.

ASM Framework builds on existing frameworks like Graded Surveillance Measure that were initially implemented to act as an alarm system for investors

As stated in the NSE FAQs,

The main objectives of the SEBI's Surveillance Frameworks are to

- Alert and Advise Investors to be extra cautious while dealing with stocks included in the ASM List

- Advise Market Participants to perform due diligence especially when dealing with these stocks

For a stock to be included under the ASM Framework, the stock price must have triggered several warnings based on certain dynamic statistical parameters

As listed these tracked parameters include (changes in)

- High Low Variation

- Client Concentration

- Close to Close Price Variation

- Market Capitalization

- Volume Variation

- Delivery Percentage

- No. of unique PANs

- PE ratio of the Stock /Company

Furthermore, there are two sub categorization under the ASM

- Long Term Additional Surveillance Measure

- Short Term Additional Surveillance Measure

To give an Idea as to how a stock could put into either Long Term or Short Term ASM, I will attach a snapshot of one parametric trigger for each selection.

Pic1: Long Term ASM Selection Criteria (There are 7 in total any of which can be triggered)

All such identified stock will directly move into stage 4 of Long Term ASM within T+3 days of triggering any of the parameters and shall remain there for a period of 90 days. Following this, should the performance of the parameter improve, the stocks will gradually move into Category 3, 2 and 1 in that order before being released from the ASM Framework. While under ASM and especially Cat 4, there are several restrictions on trading these stock such as 100% margin requirements etc.

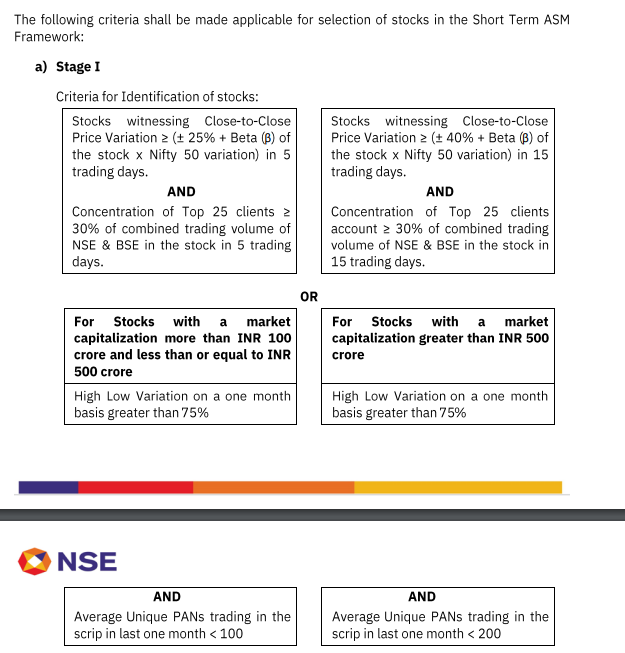

Pic 2: Parametric Triggers for getting selected into Short Term ASM

For Stage 1 of Short Term ASM, the identified companies will be asked if there is any corporate announcement that has not been shared with market and if so they would have asked to immediately go ahead with disclosures, among other restrictions. The aim here would be to prevent insider trading /trading on material non-public information by a few well-placed entities.

Note: PSU Banks are exempt from being placed under either Long Term or Short Term ASM Frameworks (Perhaps to prevent mass hysteria due to worries of a Bank run).

Stocks can be under the Short Term ASM Framework for 5 - 15 trading days. Any longer and the stocks could be placed straight into the Long Term ASM list where further restrictions will be applied for a longer period of time.

Long Story Short: Long Term and Short Term ASM Lists are made to identify stocks that could be manipulated by vested entities. The sub classification would depend on the severity of the volatility in price movement and the restrictions in trading that would follow are an indication of this severity. These stocks can’t be pledged /used as collateral and trading in them would require a lot more capital and limits on leverage as well. Overall it would not be a good look for the companies in question.

The ASM Framework has suddenly come to prominence because of the recent extreme volatility in Adani Group company shares following the Hindenburg "Short Seller's" report. The NSE has decreed that three Adani Group stocks - Adani Enterprises, Adani Ports and SEZ and Ambuja Cements would be placed under the Short Term ASM Framework from Feb 3, 2023. So for the next week or so, trading volumes in these stocks would probably fall drastically.